The purpose of a school budget is straightforward — to create and implement a financial plan, which will support appropriate funding for all programs benefiting the students. We all know that the school budget has a deeper impact than simply keeping the school afloat. Through the pathway of best school budget practices, students will receive learning experiences of utmost quality and carry this knowledge into adult life. Despite its importance, the task of writing a budget may seem extremely daunting. That is why we at Your Agora broke down the complicated school budgeting process to a digestible guide.

We researched the best practices from leading financial experts and will guide you through the journey of implementing them for your school’s success. The information based on findings by GOFA, The Rennie Center, Harvard Business Review, and other reputable sources for finance in education, shows school budget practices that prioritize student achievement within available resources. By the end of this guide, you will be able to understand the planning, preparation and evaluation processes of school budgeting.

5 Steps to School Budgeting

The Department of Education released a staggering report on school budgeting. For example, 60.6% of secondary schools spent more than their income in the 2014-2015 school year. Even worse, by 2020, mainstream schools in the US would need to earn over 3 billion dollars (in surplus!) to come close to meeting cost pressures. The students are already suffering. The same report states that the failures in school budgeting have caused an 8% decrease in spending on students since 2014. That’s over 2% a year. The numbers will only keep increasing as the cost pressures rise and schools fail to manage them. The only way for the school to persevere these challenges — the school leaders mastering the intricacies of school budgeting.

TDLR: Schools all over the world struggle with proper budgeting on a terrifying scale. And the situation is projected to get worse. To avoid joining the staggering statistics, follow this school budgeting 5-step process, backed by hundreds of theorists, researchers, statisticians, and financial experts.

Step 1 Plan and Prepare

Objectives of Budget Planning

When preparing the new budget, the main objectives of a school budget should be at the crux of your planning process. All the unique features of your school’s budget will revolve around these basics. You can’t go wrong by familiarizing yourself with these concepts. To avoid feeling overwhelmed by various expenditure factors, remember the three clauses of school budgeting:

1) Most importantly, the budget must be balanced, so that the current revenue stream meets current school spending; 2) The budget must meet all applicable legal requirements, including federal, state and local; and, 3) the budget must provide a basis for evaluation of the school's services, costs and accomplishments

With the main objectives in mind, you are ready to begin the budgeting process. First, your administrative team needs to analyze your school’s spending from the last school year. If you are just starting out and do not have data available, it is best to look at similar schools’ budgets (consider the type, structure, size, location, etc) and gather all available data projections for your own school. Continue reading to learn what data you need to create the optimal school budget. The analysis of previous budgets may include the following data:

-

informal and formal audits

-

review of instructional versus non-instructional costs

-

study of budgeted versus actual expenditures

-

various projections of increases in student enrollment

-

impact on facilities

It’s important to review past and future budgets to ensure that they meet various requirements, including statutes, instructional goals, policies, and collective bargaining agreements. The plan and preparation step is there for you to make all necessary initial adjustments. Your budget will constantly evolve through the evaluation process, but knowing how to find accurate numbers for the initial budget will be a valuable skill set for the health of your future financial planning ventures.

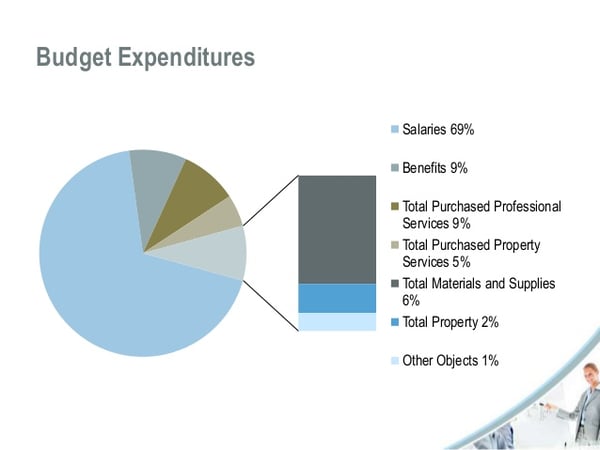

But, let’s not forget the basics. It’s crucial to track and understand where the majority of your school spending goes. The school budget breakdown example below included salaries and benefits of all staff (including contract labor costs), costs of running and repairing the physical facility, costs of materials and supplies (including machinery and equipment), and leaves wiggle room of 1% for other expenses. Your school’s expenditure breakdown needs to be extremely thorough for an optimal new budget.

Step 2 Set Goals and Priorities

First, write a list of your goals and break them down into measurable units. It’s crucial that each goal is measurable, specific, and attainable. Second, analyze your goals and hypothesize the spending priorities for the school. Remember, each spending priority must satisfy a specific goal or a requirement. Ask yourself and your administrative team — How will spending priorities support your school-wide purpose? How will your team ensure you are meeting federal, state, and local standards?

Second, look at your list of goals and priorities. What is keeping your school from reaching each goal in its current state? Brainstorm ideas that would fill the gap between the goal and its realization. Is it a budgeting issue alone? Or, will other factors, such as staff allocation, need to be revised to reach the goal? These factors will affect the timeline of your goal realization and spending.

Think about potential instructional priorities. This number should be limited and each priority must be based on solid research. For example, your instructional priorities may include web-based learning, classroom management, and smaller class sizes. However, before you come up with the final list, make sure to weigh many research-based options against one another. Instructional priorities will set the pathway to your school’s performance optimization, and the focus of your team’s spending priorities designation should be here.

There are many aspects to consider during the goal-setting and prioritization step. However, don’t be overwhelmed by the questions. The more you and your team come up with creative ideas through this collaborative process, the better chances you have for sustainability of budgeting practices. Thorough research of evidence-based practices is your best friend in this process.

Step 3 Real Cost of Priorities

In this step, you will need to take a deeper look into current resources and expenditures. You will calculate all of the existing factors to identify your school’s capacity in achieving its goals. This process requires two important steps:

- Cost analysis: involves evaluating the cost of various spending ventures (projects, innovations, programs, policies, etc) in relation to the resulted outcomes. The three steps of a cost analysis of each project are as follows: 1) Determining the benefits of a proposed or existing program and placing a dollar value on those benefits; 2) Calculating the total costs of the program; and 3) Comparing the benefits and the costs.

- Evaluation of resources: Calculating the resources is a time-intensive, but crucial step to the process. One method for evaluating resources, suggested by Wellesley College economist, Patrick McEwan, is the “ingredients” process. The ingredients process includes breaking down the resource calculations by personnel, facilities, equipment and materials, other program inputs, and required client inputs.

Step 4 Implement the Plan

The strategic financial plan is a long-term map for implementing the school’s spending priorities. The plan is implemented through a plan of action. A plan of action puts the strategic financial plan into play, translating the plan into manageable and immediately actionable steps

Your school’s strategic financial plan should contain the following elements:

-

Articulates a shared Mission and Purpose

-

Creates a Framework and Direction that guide decisions

-

Foundation for Fundraising

-

Allocates Resources-to-Opportunities

-

Contains Tools for Monitoring performance

-

Displays Organizational Effectiveness and commitment

Your financial plan template may include a number of sections that will allow you to provide all the necessary information. The sections of a strategic financial plan document are suggested below, as proposed by a Forbes financial expert.

Section 1. Executive Summary: simply outlines the sections of your overall plan.

Section 2. Elevator Pitch: a brief description of your school.

Section 3. School Mission Statement: what is your school trying to achieve?

Section 4. SWOT: analysis of your Strengths, Weaknesses, Opportunities, and Threats

Section 5. Goals: determine your goals for the next five years, one year, quarter, and a month.

Section 6. KPIs: Key Performance Indicators are performance measurements for your school’s achievements. For a school, KPIs may be test scores, administrative expenses, average daily attendance, etc.

Section 7. Target Audience: outlines the needs of your students, parents, community, and stakeholders.

Section 8. Industry and Competitive Analysis: how is the niche that your school falls under-performing compared to education industry standards? Are similar schools to yours performing well? What are your advantages over them?

Section 9. Operations Plan: identify each of the projects that comprise your larger goals and how these projects will be completed. This includes ensuring that you possess the human resources necessary to carry out your plans.

Section 10. Financial Projections: what are the potential results for each project your school considers pursuing? Are you seeing an increase in enrollment in the foreseeable future? Use concrete financial models for these numbers.

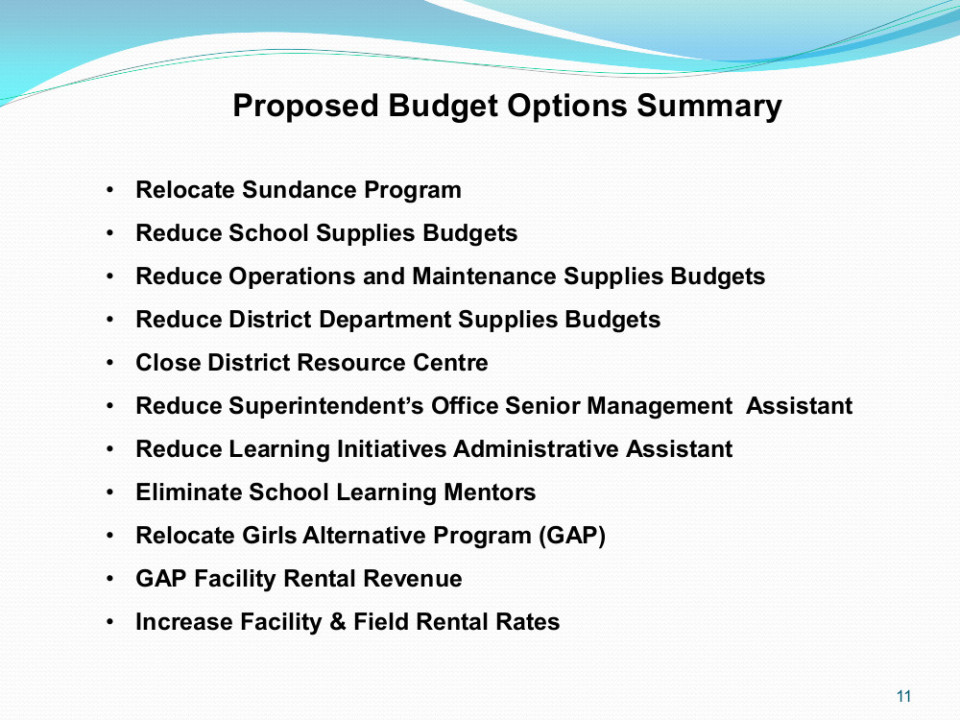

Your school’s budget presentation, which will be a cohesive document outlining your school’s budget, and should be presented at budget discussions to ensure optimal communication between team members. The budget presentation must be well-organized and clearly lay out the challenges faced by the school, and how the financial plan strategies will address the issues. Some strategic challenges may include pupil roll, staffing requirements, other resource requirements, and income projections. For example, School District 61 created a list of concrete strategies as part of its plan implementation. Consider proposing a similar list at your team’s next budget review meeting.

Step 5 Ensure Sustainability

The 2018 issue of School Planning & Management emphasizes the importance of school budget sustainability. According to Jay C. Toland, chief financial officer for Scotland County, budget flexibility is the key to sustainability. Toland suggests two strategies for ensuring a sustainable budget for your school. The first includes creating a new budget at the start of the fiscal year. The second involves making adjustments to the current budget in the midyear. What the strategies have in common is their state of constant scrutiny. The main takeaway of Toland’s theories — review, review, and adjust for a sustainable school budget. Below is the breakdown of the strategies.

New Budget

Start by looking at the total funds available for expenditures and work backward. Include the new projects first. Is your school considering spending $60K on new computers? Subtract that from the budget first. Once you go through all the projects on the list, it is highly likely that your spending will be much higher than the funds available. This is where you get the wider perspective of priorities — which cuts are less painful to implement for the accomplishment of major goals?

Midyear Budget

When revising the budget midyear, look for underused budget initiatives; you may find a number of opportunities to optimize those funds by spending them elsewhere. The majority of school expenditures are tied to salaries and benefits. Review your vacancies list. Can the funds designated to vacant spots be diverted temporarily or permanently? The next highest expenditure, as we’ve seen in Step One, is the operations and services costs. After reviewing the services costs of your school, contact your vendors and consider reducing or eliminating underused services.

Both strategies only work if you have a strategic plan, as outlined in Steps 1-4. Step 5 is here to ensure that your school sustains healthy budget practices. This includes ensuring that your school’s investments are justified and meet the goals of your institution. That’s why we created the best investment for our own schools, Your Agora — a budget-friendly solution for your specialized language programs.

Your Agora provides teachers with powerful, comprehensive tools to improve workflow and make teaching more collaborative and interesting. With features such as auto grading, course management, interactive assignments, a dynamic calendar, and customizable syllabi, Your Agora makes classroom management a seamless experience for students, teachers, and administration.